How does a debt collection agency in India work?

As the Indian economy grows, so does the finance sector. Financial companies use technology at every step. The “India Stack” of Aadhar, UPI, and Mobile networks have revolutionised lending activities in India.

As the volume of these businesses grows, there is more and more scope for automation and outsourcing on a large scale.

Like other parts of the world, the Indian market has a massive demand for good debt-collection software. This article aims to provide a 101-level understanding of How Debt Collection Agencies work in India and most parts of the world.

The “India Stack” of Aadhar, UPI, and Mobile networks have revolutionised lending activities in India. As the volume of these businesses grows, there is more and more scope for automation and outsourcing on a large scale.

What is debt collection or loan collection?

Banks, credit card companies, NBFCs that provide loans, and telecom companies must collect money regularly from their debtors or borrowers.

The soft follow-up or reminder process to the borrowers and debtors is called “Debt Collection” or “Loan Collection.”

Debt collection agency

Generally, companies have an in-house collection department or outsource the work to third-party agencies. These agencies are called “Debt Collection Agencies”.

These debt collection agencies work for many clients, including Banks, NBFCs, Telcos, and other organisations.

Difference between debt collection and debt recovery

Debt collection is generally a soft method of reminding debtors (or borrowers) that the amount is due. Most borrowers pay on time with soft reminders.

Debt recovery is required when soft collection methods don’t work. The Debt Recovery Law governs debt recovery in India.

Borrowers are of two categories, based on their behavior:

- Borrowers who need a gentle reminder generally pay by the due date.

- Borrowers who are defaulters, generally for less than 90 days.

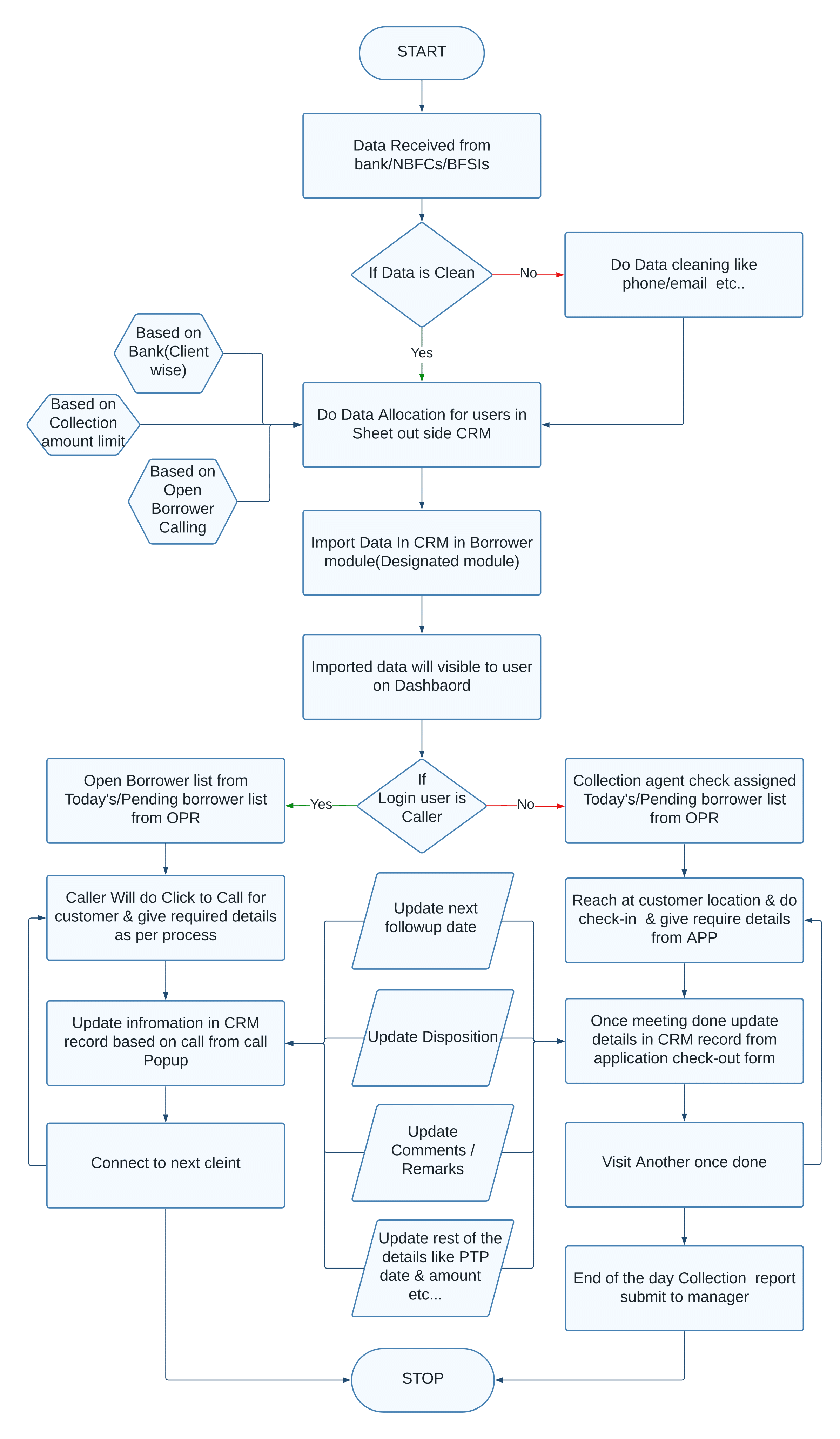

Debt collection process

Here is a step-by-step process for Debt collection work in India and most other countries:

- Clients (Banks/NBFCs) provide the agency with borrowers’ data. Clients share data monthly with Agencies, but it may vary.

- The Debt Collection Agency’s admin uploads the data into the Debt collection software and allocates the borrower’s records to Agents.

- Based on the client’s script, these agents call and speak to the borrowers.

- Agents enter Call disposition into the software based on the discussion with the borrowers.

- Call dispositions may include Calling again, visiting physically, promising to pay, or already paid. Call dispositions may differ from client to client and process to process.

- If the field agent has to visit the borrower’s place, they mark that in the mobile app provided by Debt Collection Software.

- Field agents may or may not be allowed to collect the payment in cash from borrowers.

- The agency has to submit the report to the clients regularly. Clients define the format for the reports they require.

The debt collection process varies from agency to agency and may also differ depending on the lending company (the creditor), e.g., a Bank or an NBFC.

Debt collection process flow chart

Download the Debt Collection flow Chart as PDF.

Debt collection challenges

As with any other business in this dynamic world, Debt collection work faces unique challenges due to its unique process. Here are some of the challenges faced in Debt Collection.

- Data Privacy. Lots of regulatory compliances.

- Very high employee turnover.

- Significant data churning is required.

- Some borrowers may find unpleasant jobs challenging to handle.

- Borrowers speak different languages that require a specialised team.

- They are calling script (that agent needs to speak).

- Expert-level capabilities in handling vast amounts of data.

However, technology helps these debt collection agencies work smoothly with “Debt Collection Software.”

What is debt collection software?

Debt collection software solutions manage the entire end-to-end process for debt collection agencies and creditors.

It generally includes the following features:

- A CRM tool with robust and flexible data management capabilities.

- Integration with Telephony platforms (local or cloud) for calling purposes.

- Auto-dialler for efficient process handling for tele-callers.

- Mobile app for field agents to track their visits and enter payment details.

- Robust reporting capabilities to submit reports to clients.

Sangam CRM is automated debt collection software with all the features required for an agency’s efficient and smooth performance, as well as an integrated telephone, CRM, and mobile app.

Role of debt collection software or debt collection CRM

Let me give you points by taking Sangam CRM as an example. It is the best Debt Collection Software available in the Indian market.

- Integrates Calling solution and database solution.

- Easy import of the data received from Banks/NBFCs.

- Ability to manage different projects simultaneously Since agencies work with many clients simultaneously.

- Mobile App for the field force.

- Team Leaders have dashboards and reports for analysing the performance of agents and field forces.

- Efficient allocation of borrowers’ records to the Agents.

- Single click calling for the agents.

- Performance monitoring features like Break management, Auto-calling, Live Dashboard, and many more.

- Managing the process for debt recovery where legal action is required.

Web-based debt collection software creates a level playing field for Debt collection agencies. With affordable cloud and mobile technologies, starting a Debt collection agency requires very little investment.

Sangam CRM: The Most Flexible Debt Collection Software

Empowering Debt Collection Agencies, loan Collection agency, Credit Card Companies, and Insurance Companies with cutting-edge Debt Collection Software.